Is Freedom DR a Good Company?

| Company Overview | |

|---|---|

Freedom DR was founded in 2002 by Andrew Housser and Brad Stroh, two Stanford Business School graduates, with a mission to “provide financial solutions, services, and education that enable people to reduce debt, build wealth, and achieve financial freedom.”

Housser and Stroh also founded Freedom Financial Network (the parent company of Freedom DR) to help consumers on their financial journey. They have since developed companies and solutions for personal loans, home equity, and financial education.

Since its inception, Freedom has resolved debts for over 800,000 clients.

Freedom's many years of service has earned them a positive reputation. They were a founding member of the American Fair Credit Council (AFCC) and helped the Federal Trade Commission (FTC) establish rules to improve the debt settlement industry.

They are also a platinum accredited service center of the International Association of Professional Debt Arbitrators (IAPDA).

With locations in San Mateo, CA and Phoenix, AZ, FDR employs over 2,000 professionals. To support their local communities, FDR supports a variety of charities and organizations, such as Samaritan House and The Family Giving Tree.

| Q&A | |

|---|---|

| Can I trust Freedom? | Freedom is a reliable debt assistance company and we highly recommend them.

They are accredited by the American Fair Credit Council (AFCC) and the International Association of Professional Debt Arbitrators (IAPDA). They have also received a 4.7/5 star rating from over 15,200 verified customer reviews. 94% of those reviews were positive, giving Freedom 4- or 5- stars. |

| Are there termination fees if I withdraw from the program? | If you choose to quit the Freedom program, there are no termination fees or penalties. The money in your designated savings account will be returned to you, except for any settlement fees they earned. |

| How long does the settlement process take with Freedom? | The debt settlement process with Freedom can take anywhere from 24 to 48 months. |

| How much does Freedom cost? | Freedom does not charge any upfront fees and the initial phone consultation is free!

Once your debt is settled, they will charge you between 15% and 25% of your enrolled debt. |

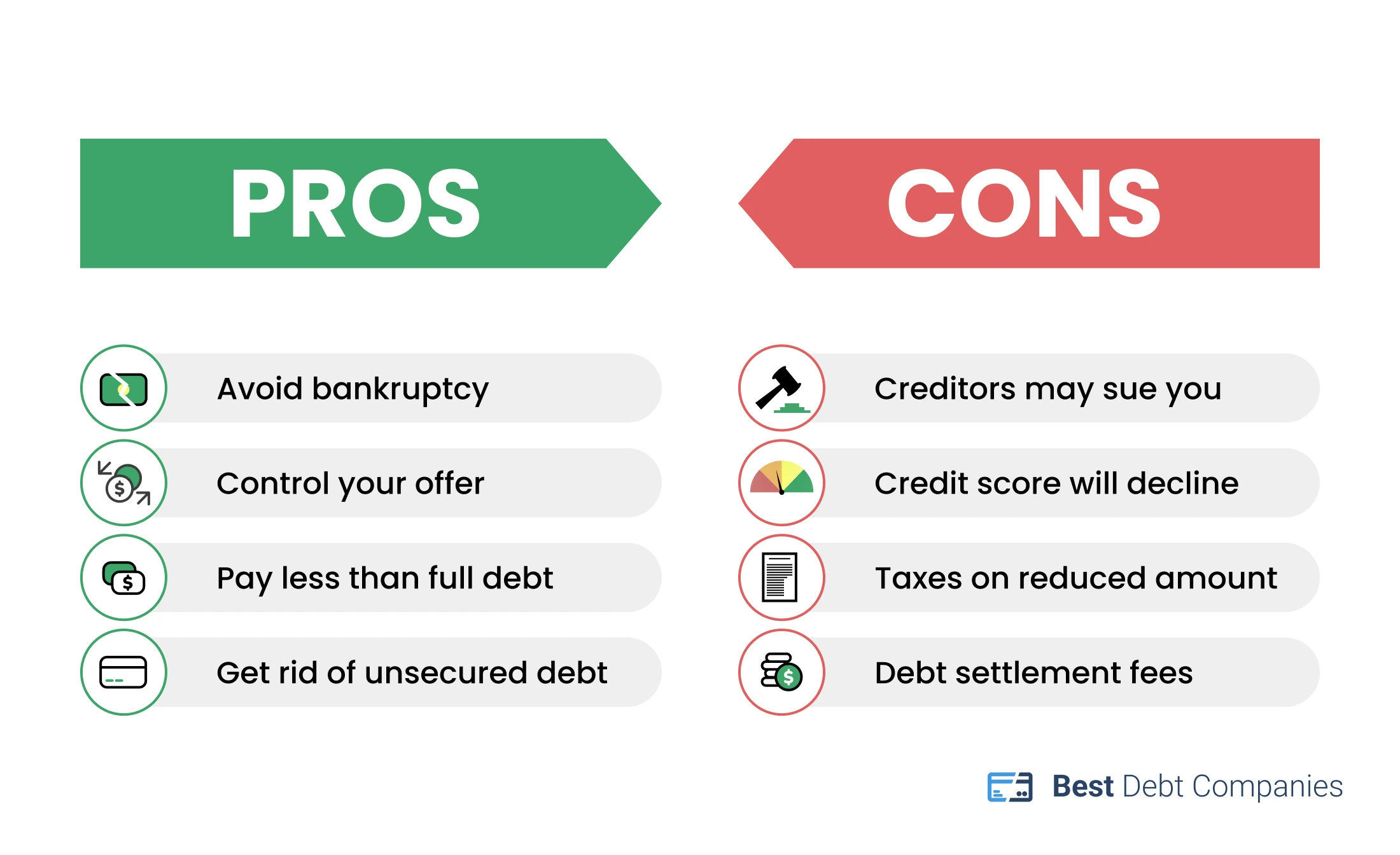

| Is it a good idea to settle debt? | It is important to understand the pros and cons of debt settlement to decide if it is the right route for you.

While you can get rid of unsecured debt, pay less than your full debt, and avoid bankruptcy, it may also decrease your credit score, you will have to pay debt settlement fees, and creditors may file a lawsuit against you. If you are on the verge of bankruptcy, can prove hardship, and are legitimately not able to make your payments, debt settlement might be a good option for you. |

Do Clients Like Freedom?

Freedom has received over 15,200 reviews from verified customers on BestCompany.com. Overall, they have earned a 4.7/5 star rating.

Of those Freedom reviews, 94% have given them 4- or 5- stars, so the majority of clients have enjoyed their experience.

Positive Freedom reviews frequently mention:

- Outstanding customer service & communication

- Compassionate staff

- Debts successfully settled & money saved

- Convenient & accessible dashboard

Being in debt and owing money is extremely stressful, but customers say that as Freedom takes on their accounts and negotiates with creditors, a weight is lifted off their shoulders.

Even though most clients are happy to have worked with Freedom, there are some who had negative experiences. About 3% of customer reviews are 1- or 2- stars.

Unsatisfied customer reviews refer to:

- Contradicting information from customer service representatives

- Expensive fees

- Issues with credit cards & lawsuits

How Does The Freedom DR Program Work?

Freedom’s program is a five step process.

1. Free Consultation

Freedom offers a free debt evaluation over the phone with one of their consultants. After discussing your various debts, they’ll explain the options available to you and whether or not you qualify for their program. If you do, they’ll customize a program for your specific situation.

Schedule your free consultation with Freedom today.

2. Save

After enrolling in Freedom’s program, they will set up a separate savings account for you. You will stop paying your creditors and instead deposit that money into the account to save.

3. Settlement Negotiation

When your debt consultant believes you have enough money in your savings account to make an offer, they will begin the debt negotiation process by reaching out to the creditors. This can take several months.

According to NerdWallet, Freedom has reduced client debt by an average of 20-35%.

4. Settlement

Once a creditor agrees to the settlement, you will approve the terms. Freedom reviews mention how customers appreciate the notifications they receive when a debt is about to be settled. Money is then transferred from your savings account to the creditor.

Steps 2 through 4 repeat for each of your debts.

5. Financial Freedom

When all of your debts have been settled through the program, you graduate and begin your debt-free future!

Pros & Cons of Debt Resolution

If you are considering debt settlement simply because you don’t want to pay back your debt or it’s taking longer than you thought, debt resolution is probably not the best option for you.

In order for creditors to consider decreasing your debt, the negotiator needs to prove that you are going through a hardship and cannot make the full payment. If you cannot prove this, you may consider a different route.

Most who choose to enroll in debt resolution programs are choosing between bankruptcy and settlement .

Bankruptcy remains on your record for seven to ten years and makes it very difficult to make an expensive purchase, like a home or a car, because your private financial problems are made public.

While debt settlement will also stay on your record for about seven years, it will impact your credit score less as you work to add more positive information to your credit report.

That being said, debt resolution can be risky, so be sure to understand the pros and cons to make sure it is the best option for you.

Along with their debt settlement program, Freedom works to educate clients and help all consumers understand the ins and outs of debt resolution.

They have resources available to the public about everything from budgeting to bankruptcy.

You can learn everything there is to know about getting out of debt directly from Freedom before and as you participate in their program.

Even if you decide that debt settlement is not the right path for you, Freedom has articles to assist you in the rest of your financial journey.

Types of Debt Freedom Resolves

Freedom specializes in debt resolution, or debt settlement, which can help to resolve unsecured debts. Unsecured debts are not backed by collateral, whereas secured debts do require collateral. Examples of secured debts include auto loans and mortgages.

Unsecured debts that Freedom can help you resolve include:

- Credit card debt

- Personal loan debt

- Medical bills

- Department store credit debt

How Much Does Freedom DR Cost?

Freedom does not charge any upfront fees. The phone consultation and program setup are completely free.

However, Freedom does charge between 15% and 25% of your enrolled debt one the debt has been settled. This is why some customer reviews complain about the expensive price of their services. Even if they are able to negotiate your debt down, the debt settlement fee you will be charged is based on your enrolled rate.

For example, if you enroll in the program with a $20,000 credit card debt, you will need to pay Freedom between $3,000 and $5,000, even if they are able to negotiate your debt down to $15,000.

This is exactly why debt resolution isn’t for anyone. It is important to weigh the pros and cons of enrolling in a debt resolution program before making the decision.

Freedom vs. Other Debt Assistance Companies

We have rated Freedom #1 for Best Debt Companies for many reasons.

Their settlement fees are average among debt settlement companies, and they have received the necessary accreditations to be credible and trustworthy. Freedom also has over 20 years of experience in the debt settlement industry, while some other companies are newer to the field. The minimum debt they accept into their program is slightly lower than some other companies.

The reason Freedom stands out above the rest is the amount of customer reviews they have received and their high star rating. While other companies may have more stars, they have received significantly less reviews than Freedom.

It is very impressive that they have received over 15,200 reviews and 94% of those were 4- or 5- star reviews. Because of this, Freedom stands out above the competition.

| Customer Rating | Reviews | Minimum Debt | Price | |

|---|---|---|---|---|

| Freedom | 4.7/5 stars | 15,200+ reviews | $7,500 | 15-25% |

| National DR | 4.5/5 stars | 1,300+ reviews | $7,500 | 18-25% |

| Pacific Debt, Inc. | 4.8/5 stars | 2,300+ reviews | $10,000 | 15-25% |

| Accredited DR | 4.8/5 stars | 1,300+ reviews | $10,000 | 15-25% |

| New Era Debt Solutions | 5/5 stars | 170+ reviews | None | 14-23% |

Is Freedom DR Right For You?

Once you have decided that debt resolution is the best solution for you, it’s important to pick a company that suits your unique situation. Here are a few factors to take into consideration to ensure Freedom is right for you.

Cost

Freedom charges 15% to 25% of the enrolled debt. Can you afford to pay those fees?

Time

Freedom claims it can settle your accounts in 24 to 48 months. This is the industry average, but if you choose Freedom, keep this in mind when planning your future and the payments you’ll make to your savings account.

Debt Type

Freedom works with unsecured debt, so if you have credit card debt, medical bills, or other debt not backed by collateral, they are a great choice for you. However, if you have secured debt, like mortgage or auto loans, you will need to consider other debt assistance companies.

Debt Amount

Freedom has a minimum debt requirement of $7,500. If your debt is lower than this, you may consider a different company or a different route than debt resolution, like debt consolidation or debt management.

Location

Freedom services most of the United States, but there are a few states that their program is not available to. Unfortunately if you live in Colorado, Hawaii, North Dakota, Oregon, Rhode Island, Vermont, Washington, West Virginia, or Wyoming, their program is not available to you.

National DR is a great alternative for those that live in Colorado, Hawaii, North Dakota, Rhode Island, Washington, or Wyoming.

Customer Service

In such a stressful situation, it is important to be treated with understanding and compassion, and past customers have said they felt that from Freedom DR professionals.

Past clients have also expressed their gratitude for how much money they were able to save through debt settlement with Freedom.

Overall, we recommend Freedom DR because of the thousands of positive experiences verified customers have reported.