Quick Look at Global Client Solutions

| Company Overview | |

|---|---|

Global Client Solutions (GCS) LLC is a third-party payment processor for consumers going through debt resolution. The online platform was founded in 2003 and is headquartered in Tulsa, Oklahoma. Their parent company is Global Holdings.

GCS processes payments for consumers that are enrolled in outside debt resolution programs. The purpose is to help people resolve their credit card debt with an account to save money and have monthly payments automatically distributed.

Many consumers will come across this company when working with a debt management company.

This is not a debt resolution company, so GCS is not accredited by the IAPDA (International Association of Professional Debt Arbitrators) or the AFCC (American Fair Credit Council) like most reliable debt relief companies are.

Try the #1 Debt Relief Company

Global Client Solutions processes payments, but they do not offer debt negotiation services. Clients have also had negative experiences working with GCS.

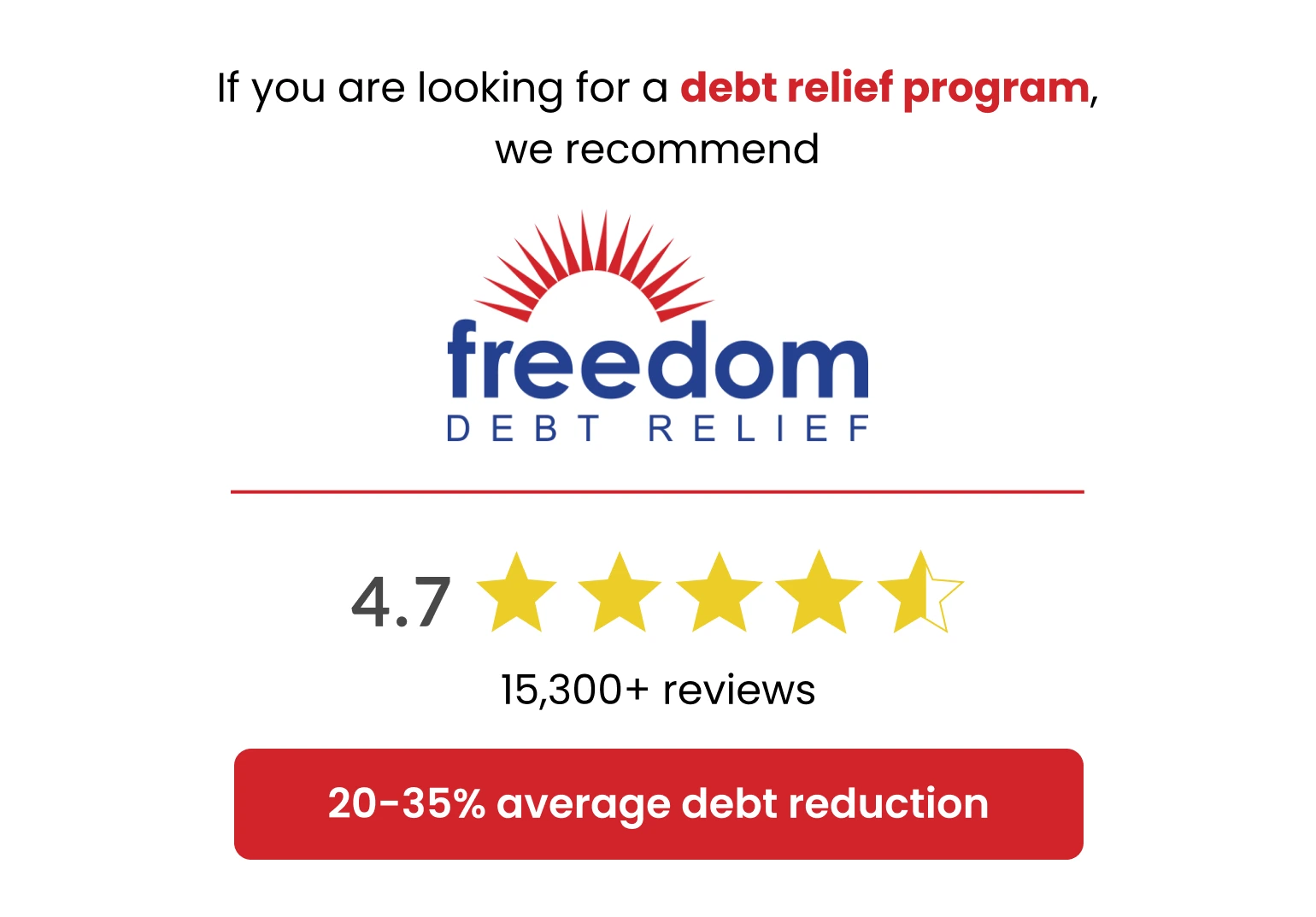

If you are searching for a trustworthy and compassionate debt resolution program, we recommend Freedom Debt Relief. Read Freedom Debt Relief reviews to learn why they have earned 4.7/5 stars from over 15,300 reviews.

See other top-rated debt relief companies.

| Q&A | |

|---|---|

| What does Global Client Solutions do? | Many people mistake GCS as a debt resolution or settlement company, but they process payments for clients working with those companies.

GCS sets up an individualized account for each of their clients. Clients deposit funds into this account instead of paying creditors. When the debt resolution company has finished negotiating with creditors, GCS disperses the account funds to the creditors. |

| Should I trust Global Client Solutions? | We do not recommend GCS at this time. They have received many negative reviews from customers who were upset with the many fees and disrespectful customer service.

GCS has also been sued multiple times regarding their fees. They are also not transparent about their pricing information. |

| Is my account secure with Global Client Solutions? | Yes, all accounts are insured by the FDIC. Clients have complete control over their account and can access it 24/7. |

Do Customers Like Global Client Solutions?

Global Client Solutions has not received many reviews, but the reviews that have been written are mostly negative. Only 24% are 4- or 5-star reviews and 71% are 1-star reviews. After 20+ reviews, GCS has a customer rating score of 1.9 out of 5 stars.

The few clients who were satisfied with their experience praised GCS for their knowledge and frequent communication.

However, the majority of clients had negative experiences and left reviews that complained about:

- Expensive and unexpected fees

- Debt situation did not improve

- Disrespectful customer service

Many of these unsatisfied clients warn potential clients to do their research and read the contract in depth before signing.

Those searching for debt solutions are in a difficult situation, so many companies, like Freedom Debt Relief, are praised for their compassion and understanding. Unfortunately, many clients have had poor experiences with the customer service representatives from GCS.

How Much Does Global Client Soluitons Cost?

Unfortunately, Global Client Solutions is not transparent about their pricing.

Some customer reviews complain about a large upfront fee to open the account. In response to one client complaint about monthly payments, GCS responded that the monthly fee to keep the account open is $8.35.

GCS has received numerous complaints, including a 2011 lawsuit regarding numerous service fees on the company’s special purpose accounts.

Plaintiffs stated that signing a special purpose account application authorized the company to charge a one-time account fee of $9, a $9.85 monthly service charge, and a $15 fee per wire transfer. Other various fees were also involved.

Illegal Upfront Fees

Global Client Solutions was charged with an enforcement action in 2014 from the Consumer Financial Protection Bureau (CFPB).

The CFPB claimed that the company allegedly charged consumers illegal upfront fees since late 2010. GCS was asked to stop all illegal activity and pay consumers over $6 million in resolution and $1 million in civil penalties.

Global Client Solutions Services

Global Client Solutions does not offer negotiation services to help consumers reduce the total amount of debt owed. You will still need another company to help negotiate and get resolution offers from your creditors.

They offer a unique service in allowing clients to set aside their money into a dedicated account until they are ready to pay settlements.

This might prove particularly useful for those in credit card debt, because the money in their GCS account cannot be spent.

Again, GCS is a third-party payment processor, so they do not negotiate with creditors on your behalf. If you are searching for a debt resolution program, we recommend looking into Freedom Debt Relief.

How Does the Account Work?

Global Client Solutions sets up an individualized account under the client’s name for making loan payments to creditors. This account can be accessed anytime day or night.

All accounts established through GCS are fully insured by the FDIC.

While working with a debt management company, clients make deposits into this account, which allows customers to accumulate, disperse, and track funds for debt resolution purposes.

Funds can automatically be deposited into the GCS account by giving Global authorization to access your checking or savings account.

After the outside debt settlement company has negotiated with creditors and come to a consensus, the money in the GCS account will be used to pay settlements.

They will distribute the funds to your creditors.

Once your debt settlement plan has been fulfilled, you can request the remaining balance in your account to be returned to you.

Global Holdings App

Global Client Solutions has an app through their parent company, Global Holdings. The app can be downloaded and used on any iOS or Android device.

Once the app is downloaded, clients can log into their account and access account information at their fingertips.

Lack of Transparency

The Global Client Solutions website contains very little information about the company, its fees, and practices. It is basically a site with contact information to help you get in touch with the customer service, sales, and support teams, or login to access an existing consumer account. It doesn’t even let Google crawl to create a page description.

Our Recommendation

If you are searching for a company to help negotiate your debt with creditors, Global Client Solutions is not an option. They are a third-party payment processing service, and they do not offer any debt settlement programs.

GCS also has significant legal problems, high costs, and a poor customer rating, making it difficult to trust their services.

Because of their negative reputation and the fact that they merely process payments, we recommend looking into a reputable debt resolution company such as Freedom Debt and Pacific Debt.