Quick Look at DMB Financial

| Company Overview | |

|---|---|

Since 2003, DMB Financial has managed over $1 billion in debt and helped 30,000+ people become debt free. DMB Financial is not a law firm, but they do employ attorneys to help with debt resolution.

Many debt resolution companies also offer debt consolidation, credit counseling, bankruptcy, and sometimes even tax debt resolution. DMB Financial does not specify whether they offer any of these additional services.

To get started, DMB Financial offers free consultations to determine if a debt management program is right for you.

DMB Financial negotiates debt on behalf of their clients. These debt resolutions are reached once your account is delinquent and has gone into debt collection. Instead of continuing to make monthly payments on your credit cards, DMB Financial will have you set up a savings account that you deposit money into monthly.

That money that you set aside will be used to pay off your balance at a fraction of what you actually owe, without further interest.

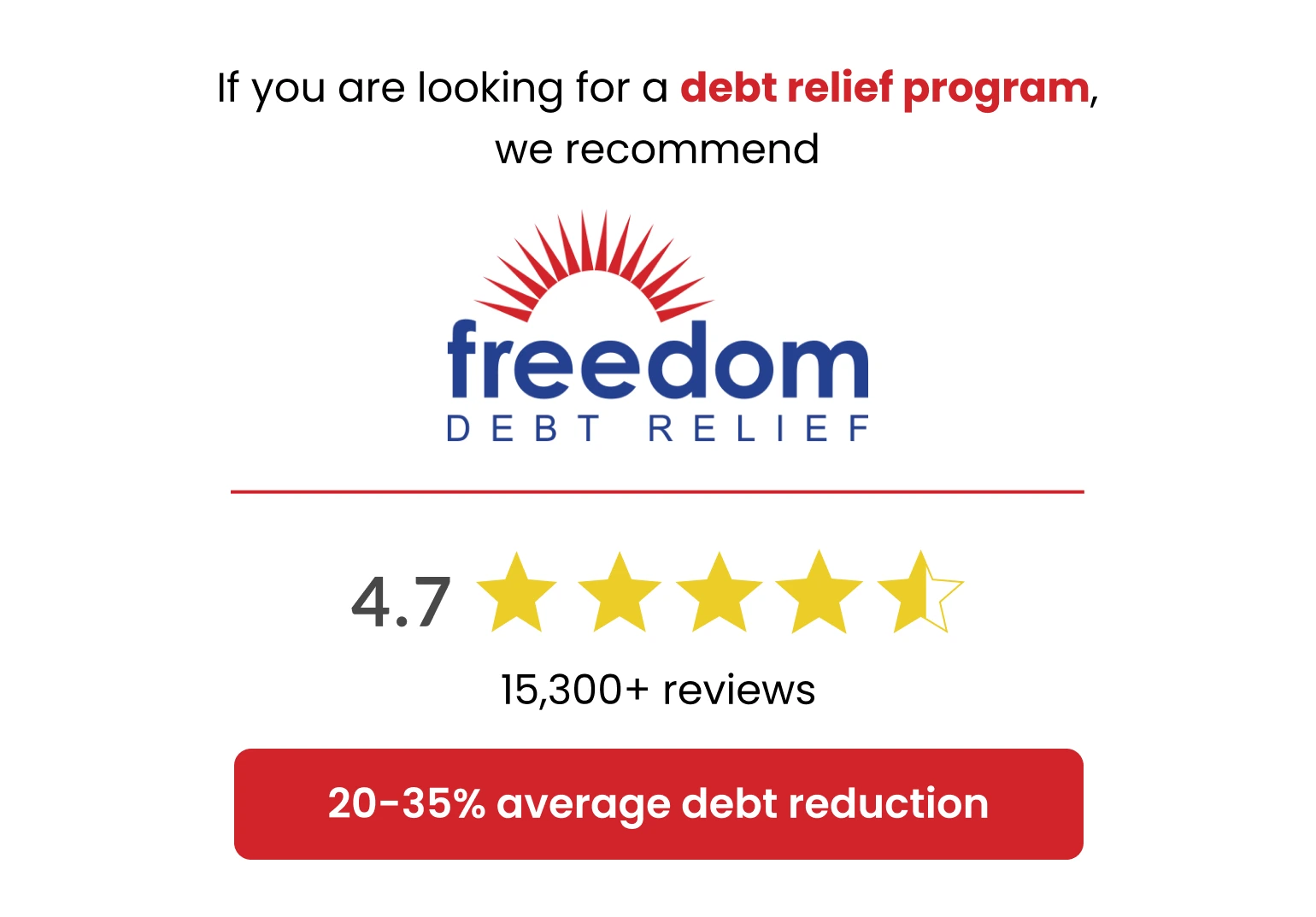

Try the #1 Debt Relief Company

DMB Financial does not disclose information on their website regarding their fees and minimum debt requirement. We recommend Freedom Debt Relief for their transparency. They charge 15% to 25% of the total enrolled debt and their minimum debt requirement is $7,500.

DMB Financial also has a poor customer rating and has only received reviews from a few verified customers, but Freedom Debt Relief has a 4.7/5 star rating from over 15,500 reviews. Learn why customers enjoy working with Freedom Debt Relief by reading their verified customer reviews.

| FAQs | |

|---|---|

| What are DMB Financial’s fees? | DMB Financial does not disclose any information regarding their fees. Most debt resolution companies charge a percentage of the client’s enrolled debt, ranging on average between 15% and 25%.

As a debt resolution company, they are prohibited from charging upfront fees, so clients will not be charged until a settlement is reached. |

| How much debt can I enroll in their debt resolution program? | DMB Financial is also not transparent regarding the minimum or maximum debt requirements.

The most common minimum debt requirements in the industry are $7,500 and $10,000. |

| Will debt settlement hurt my credit score? | Debt settlement programs instruct clients to stop making payments to their creditors and begin making monthly deposits into an FDIC-insured savings account while they negotiate with the creditors.

This period of time when clients stop paying creditors can negatively affect their credit score. |

Do Clients Like DMB Financial?

DMB Financial has not received much feedback on BestCompany.com, but the company’s average customer rating is 2.5 out of 5 stars from the 30+ verified customers who have left reviews. It appears that customers either have a great experience or a terrible one, because 38% are 4- or 5-star reviews and 62% are 1- or 2-star reviews.

We recommend reading over these reviews before committing to use DMB Financial.

Many of the positive reviews mention:

- Frequent communication

- Respectful & friendly advisors

- Knowledgeable & helpful debt advice

One customer who was able to successfully settle their debt with DMB Financial recounted:

"I ended up settling my credit cards - one for 50% of what I owed and the other two for around 40%. The staff was VERY helpful and answered all of my questions - which I had a ton. I strongly recommend them to anyone who has debt problems." - Ken

The majority of reviews are negative and complain about:

- Expensive fees

- Disorganized management

- Very slow results

- Changed advisors several times

Many reviews from upset customers expressed that they felt deceived by some of the unfulfilled promises made by DMB Financial.

DMB Financial Process

1. Free Consultation

A client meets with a Program Consultant to explore their options and the ways DMB Financial could assist them.

2. Customized Program

DMB Financial creates a program that is customized to the client’s unique situation.

3. Savings Account

DMB Financial sets up a savings account for each client that is insured by the FDIC (Federal Deposit Insurance Corporation). Clients deposit money into this account to save up enough to pay off their debt.

4. Negotiation

While clients are saving money, DMB Financial negotiates settlements with creditors. When they come to an agreement, the money in the savings account will be used to pay the creditors.

DMB Financial Refer a Friend Program

Clients have the opportunity to earn a gift card of up to $200 by referring friends and family to DMB Financial.

After DMB Financial settles the first debt of the client’s referral, the client will receive a gift card.

The amount of money on the gift card depends on the referral’s enrolled debt:

- $20,000+ Enrolled Debt: $200 Gift Card

- $10,000 - $19,999 Enrolled Debt: $100 Gift Card

- $5,000 - $9,999 Enrolled Debt: $50 Gift Card

DMB Financial Undisclosed Information

It can be difficult to decide which debt resolution company best fits your unique financial needs. The more transparent a company can be about their costs, fees, services, qualifications, and creditor relationships, the easier it is for you to know if they’d be a good fit for you.

Unfortunately, DMB Financial’s website is not transparent. To get accurate information about any of the following topics, we recommend contacting them directly.

Cost & Fees

Most debt resolution companies charge a percentage of the debt clients enroll with them. Usually, this fee ranges between 15% and 25%. DMB Financial does not list what their fee is.

DMB Financial does not specify whether they charge upfront fees, but within the debt settlement industry, it is illegal to charge upfront fees. Because DMB Financial is a legitimate debt resolution company with industry accreditations, we know they do not charge upfront fees.

Many large debt resolution companies provide an average of how much money they save their clients. For example, some companies resolve debts at 50% of what is originally owed. This information is not shared by DMB Financial.

Information regarding cancellation fees or a money-back guarantee is also not disclosed on their website.

Services & Qualifications

Based on their process, we know that DMB Financial provides debt resolution services. However, they do not specify if they offer any other debt assistance programs, like debt consolidation, credit counseling, debt management, etc.

Most debt resolution services are only able to resolve unsecured debt, meaning debt that is not backed by collateral, like personal loans, credit cards, and medical bills. DMB Financial most likely only accepts unsecured debt, but this is not confirmed on their website.

The majority of companies who specialize in debt resolution also have a minimum debt requirement. For example, Freedom Debt Relief has a minimum debt requirement of $7,500. Unfortunately, DMB Financial does not disclose their minimum debt requirement or any other qualifications needed to enroll in their program.

Location

DMB Financial is headquartered in Massachusetts, and their program is available in 26 states. The company says they do not service Georgia and “other states”.

To determine if they are an option for debt resolution where you live, you can give them a call, or you can browse our top debt resolution companies to see what states they are in.

Creditor Relationships

Large debt management companies have relationships with the biggest creditors (banks and credit card companies). If clients see their creditor on the list of creditor relationships on a debt resolution company’s website, they can be confident that the company will be able to successfully negotiate their debt.

DMB Financial does not list what creditors or debt collectors they have worked with in the past, so potential consumers can’t see if DMB can help their particular situation.

Our Recommendation

While some customers have had positive experiences working with DMB Financial, it is difficult for us to recommend them at this time due to their lack of transparency.

Because they do not disclose information about their fees, services, minimum debt requirement, and even locations, customers who are interested in their program will need to call them directly to see if they qualify.

If you are searching for debt resolution services, we recommend looking into companies who are more transparent and have more informative websites, like Freedom Debt Relief.