Quick Look at Rescue One Financial

| Company Overview | |

|---|---|

Rescue One Financial was founded in 2007 by Branden Millstone and Bradley Smith, who is now the CEO. They are headquartered in Irvine, CA.

They employ many consultants and professionals who strive to “help with your financial future and get you on a path to being debt free.” Since its inception, Rescue One Financial has resolved over $5 billion in debt.

Try the #1 Debt Relief Company

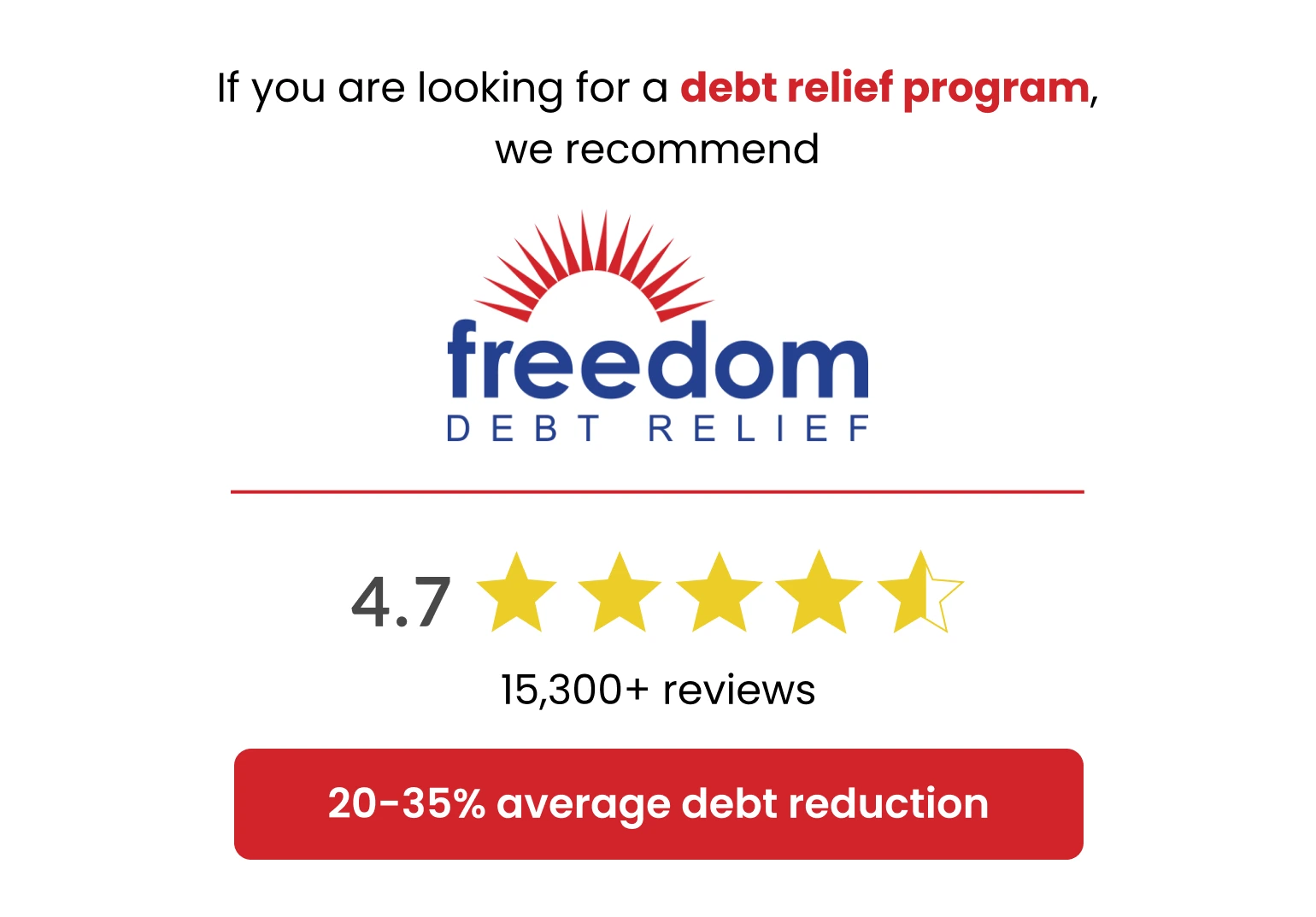

While Rescue One Financial has a poor star rating and has only received reviews from a few verified customers, Freedom Debt Relief has a 4.7/5 star rating from over 15,300 reviews.

Customers consistently mention how compassionate and understanding the Freedom Debt Relief professionals are and how they successfully settled their debt. Read Freedom Debt Relief reviews to learn more.

| FAQs | |

|---|---|

| What is Rescue One Financial? | A debt resolution company that frames itself as an alternative to bankruptcy. The company works with your debtors to resolve for a fraction of what you owe. |

| Who is this program for? | This debt resolution program is for people who are either already delinquent on their accounts, or who are not able to meet their monthly payment. This program helps with unsecured loans, credit cards, medical bills, and autos in repossession. |

| How long will it take? | Program takes 24-48 months to complete. |

| How much will I save? | Rescue One will work with your creditors to resolve your enrolled debts for an average of 50% of what you owed. After their fees, you end up paying 68-85% of what you owed. |

| How must will it cost? | 18-35% of the debt you enroll. |

Do Customers Like Rescue One Financial?

Unfortunately, there are not many reviews of Rescue One Financial. Of the few verified customer reviews that have been written, 50% are 4- or 5-star reviews and 50% are 1-star reviews, so customers seem to have very mixed experiences with Rescue One Financial. Overall, their star rating is 2.8/5.

Those who had positive experiences with Rescue One Financial mentioned:

- Knowledgeable staff

- Successful debt settlement

- Educational resources

The other half of customers who had negative experiences complained about:

- Poor customer service

- Lost money

- Credit significantly decreased

Because there are not many reviews, it is difficult to have an accurate understanding of whether or not Rescue One Financial is a good debt relief company. Aside from customer reviews, there are other factors to consider when choosing whether or not to work with Rescue One Financial.

Pros

Industry Accreditations

Rescue One financial has AFCC accreditation and is an IAPDA member, which shows a commitment to good business practices.

Types of Services & Education Available

They offer many services including consumer loans with affordable rates, business loans, debt resolution services, debt management and debt counseling for those who want to make sure they avoid similar financial strains in the future.

They offer some debt education to those in debt or worried that they may end up there again in the future. Those who are interested in debt education should express so during the initial consultation.

Types of Debt

Rescue One Financial resolves many different types of debt. If you are struggling with any of the following, they may be able to help:

- Credit card debt

- Medical debt

- Collections and repossessions

- Business debt

- Certain student loans

While many debt relief companies focus on credit card debt, personal loans, and medical bills, it is unique that Rescue One Financial will also work with collections, repossessions, business debt, and specific types of student loans.

Relationships With Well-Known Lenders

Debt relief professionals negotiate with lenders on your behalf. Because if this, it is helpful for a debt relief company to have an established relationship with popular lenders.

Rescue One Financial has relationships with the following creditors:

- American Express

- Bank of America

- Best Egg

- CapitalOne

- Citibank

- Discover

- LendingClub

- OneMain Financial

- Prosper

- Synchrony

- USAA

- Wells Fargo

Multiple Payment Options

Rescue One Financial has multiple monthly payment options you can choose from to customize your account to fit your budget and debt management plan.

You can also speak to a financial consultant to help you determine which debt resolution and/or debt management plan is best for you before making your decision on which payment plan to go with.

Rescue One’s debt reduction program ranges between two and four years.

This makes for a quick debt resolution program and helps you get out of financial hardship faster than if you were to wait to pay your debts off at a slower pace.

Cons

Customer Service

Rescue One Financial Reviews say the company reaches out to people to work with them.

Often their advertising tactics are confusing and vague. Some reviewers have applied to work with Rescue One Financial, been turned down, and then see a negative effect on their credit. Overall, people experience unclear communication and expectations of the company.

High Fees

Rescue One Financial charges up to 35% of the total debt you enroll to use their services. For example, if you enroll $40,000 of credit card debt, you’ll pay Rescue One $15,750 max.

Similar debt resolution programs charge a max of 25%. You may also pay a minimum fee of 18% of the total debt you enroll. The amount you are charged depends on what state you are in and how much debt you have.

Our Recommendation

Rescue One Financial is a younger company with mixed consumer reviews. With a high minimum debt requirement and costly fees, we recommend going with a more reputable company such as Freedom Debt and Pacific Debt Inc.